%20(2).webp)

Are you a freelancer in the Philippines and wondering how to compute your percentage tax? You’re not alone! With so many rules from the BIR, taxes can feel overwhelming. Percentage tax is actually simple once you know the basics. In this guide, we’ll walk you through what it is, who needs to pay, how to compute it, and how to file Form 2551Q.

Filing taxes properly boosts your credibility and peace of mind as a professional. At EDGE Tutor, we believe that part of being a successful online tutor or freelancer is staying compliant and responsible with your taxes.

In this guide, we’ll walk you through what percentage tax is, who needs to pay it, how to compute it, and how to file BIR Form 2551Q the right way.

Not all freelancers are required to pay percentage tax. Here’s how to know if you are:

The formula is easy:

Gross Income × 3% = Percentage Tax

Let’s say you earned PHP 50,000 in January. Here’s how to compute your percentage tax:

PHP 50,000 × 3% = PHP 1,500

That means you need to pay PHP 1,500 for that month.

You can compute this manually or use a BIR tax calculator online. Some freelancers also use Excel or Google Sheets to keep monthly records and auto-calculate their taxes. Whatever works best for you is fine, as long as you’re consistent.

Let’s say you’re a freelance writer and here’s your income for the first quarter:

Now compute your percentage tax:

PHP 155,000 × 3% = PHP 4,650

So when you file your 2551Q for Q1, you’ll need to pay PHP 4,650 in total.

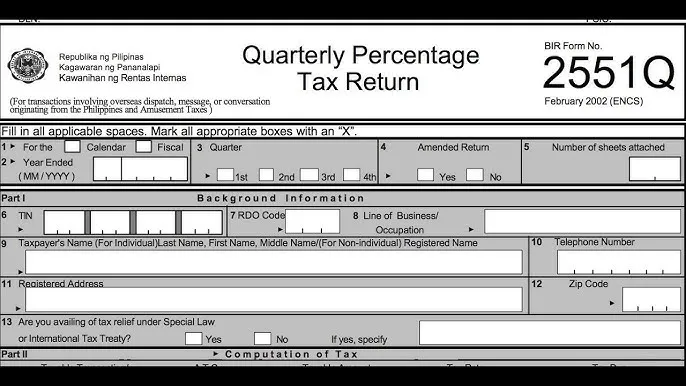

Form 2551Q is the BIR form for quarterly percentage tax. You can file it in two ways:

For payments, you can use online banking, GCash, Maya, or go to an authorized agent bank (AAB). Just make sure to pay before the deadline.

Need help with the steps? There are many free 2551Q filing guide articles and videos online, so you can follow along.

Now you do! Computing your percentage tax as a freelancer in the Philippines doesn’t have to be confusing. With a simple system, a calculator or spreadsheet, and regular income tracking, you can stay on top of your taxes with ease.

At EDGE Tutor, we encourage all our online tutors and freelancers to develop the habit of filing taxes on time. A clean BIR record opens up more opportunities, especially if you’re planning to work with reputable companies or apply for loans or travel.

Remember: Filing taxes on time helps you avoid penalties and keeps your BIR record clean. So start building your habit of filing now. You’ve got this!