%20(4).webp)

If you’re starting your freelancing journey in the Philippines, one of the first things you need to do is get a Tax Identification Number (TIN). Having a TIN is important for paying taxes, issuing receipts, and registering with the BIR. It might sound a bit overwhelming at first, but the process is actually simple once you know what to do.

At EDGE Tutor, we’re more than just an online tutor outsourcing company. We care deeply about our Filipino tutors and their growth. That includes encouraging every freelancer to be law-abiding and responsible, especially when it comes to paying taxes. Getting your TIN number for freelancers is part of becoming a legit professional and preparing for long-term success.

This guide will walk you through everything you need to know about getting a TIN number for freelancers.

The simplest way to explain it is if you're earning income, even as a project-based employee, you need to register with the Bureau of Internal Revenue (BIR). That means you also need a TIN. It doesn’t matter if you earn part-time or full-time. As long as you get paid for your services, the government expects you to pay taxes.

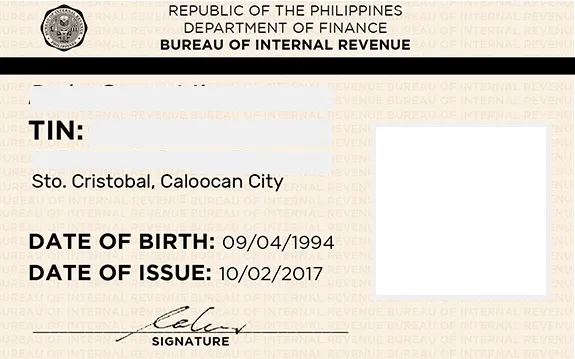

Photo from filepino.com

For first-time freelancers, the easiest way to register is by going to the BIR Revenue District Office (RDO) where you live or work. But before you head there, make sure you’re not already registered. If you had a job before, you might already have a TIN. The BIR only allows one TIN per person, so do not apply for a new one if you already have one.

If you’re sure you’ve never registered before, here’s how to apply:

Before you register for your BIR TIN registration, prepare the following:

Bring photocopies and original copies when you go to the RDO, just in case.

BIR recently launched an online portal called the BIR Online Registration and Update System (ORUS). You can now get a TIN number online if you’re a first-time applicant. Here’s a quick overview:

Note: Not all RDOs fully accept online registrations yet. If the online process doesn’t work for your area, you’ll need to go to your RDO in person.

Once you receive your TIN, that’s just the first step. You still need to register as a freelancer officially. This means:

Getting a TIN number for freelancers might feel like a lot at first, but once you’ve done it, you’re one step closer to becoming a legit and tax-compliant freelancer. It shows professionalism and helps you avoid penalties in the future.

If you want to learn more about how to get a TIN number online or need help with your BIR TIN registration, start by visiting your nearest RDO or exploring BIR’s online portal.

Good luck with your freelancing career!